Parents use this link to sign up for event: https://forms.gle/eDTbdGBBC7YmiYZR9

The online application is closed for the 2025-26 school year.

Parents use this link to sign up for event: https://forms.gle/eDTbdGBBC7YmiYZR9

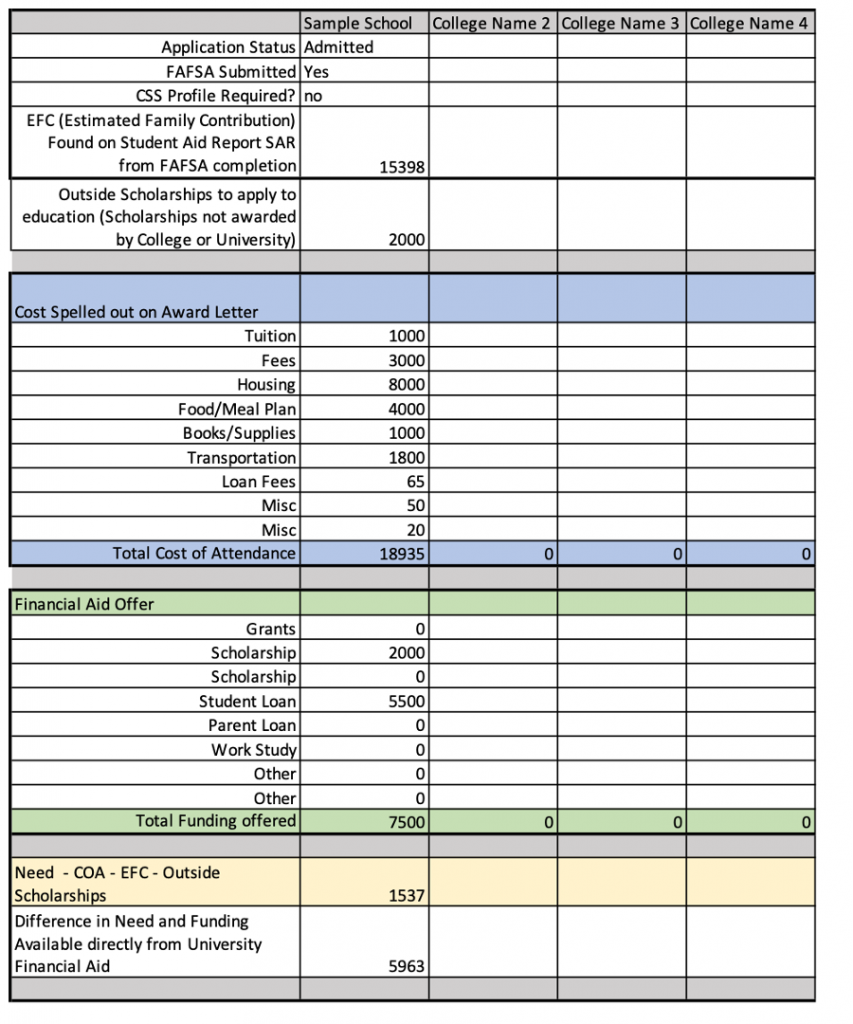

Iredell Crosby Senior Program Coordinator, Jenniffer Jamison, explains what to look for in your financial aid award letter. (Part 1 of 2)

Iredell Crosby Senior Program Coordinator, Jenniffer Jamison, explains what to look for in your financial aid award letter. (Part 2 of 2)

Learn more about scholarships available to you and how to best take advantage of these opportunities!

Learn about the Morehead-Cain scholarship, how to apply and more. The Morehead–Cain challenges emerging leaders to seize their education and positively impact the University, state, nation, and world.

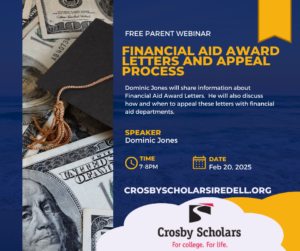

Delays and glitches with this year’s new FAFSA roll out have caused enormous frustration for students and parents seeking financial aid for the 2024-2025 school year.

“The already stressful college admissions process was thrown into chaos this year by a botched bureaucratic upgrade,” reads an April 6 CNN report, which refers to the roll out as a fiasco. “Hiccups and delays in the federal financial aid process have kept some high school seniors and current college students from getting aid packages from schools.”

Knowing the final cost is, obviously, essential to choosing a college, making financial decisions and determining living arrangements. Many feel that they’ve been left in a state of limbo.

Delays and glitches with the new form have also reduced FAFSA submissions. As of April 1, the National College Attainment Network reported that just 35% of high school seniors had submitted a FAFSA. That’s down 27% nationally and 24% in North Carolina, versus last year.

So, what should you do?

Here are some suggestions that might help you navigate this unusual year in the world of financial aid.

Need in-person help?

Mitchell Community College provides FAFSA Completion Events, hosted by the Financial Aid Department, every Tuesday from 2 p.m. – 4 p.m. in the Eason Student Services Building, Room 105. Students should create a studentaid.gov account if they do not already have one by visiting studentaid.gov/create-account. For more information on planning your visit, click here.

And finally…

Remember that you aren’t alone. Parents and students nationwide are facing the same FAFSA challenges. Colleges and universities are aware and are making adjustments. Plus, numerous issues with the new form have already been addressed.

Remember, Crosby Scholars staff is available to help answer any questions you might have as well. Feel free to reach out to Jen Jamison, Jr/Sr Program Manager and Dominic Jones, Financial Aid Coordinator.

In the meantime, do all that you can to prepare for next steps. You’ll be ready to react and take control when the time comes.

Hopefully, that time will come sooner than later.

During the admissions process, families are so focused on working to gain acceptance, that financial aid and cost is sometimes an afterthought. Not for long. The cost of college has increased exponentially over the past 2 decades and parents are often surprised at the total cost. This is often the final factor in deciding which school to attend. Here are a few things you should consider when comparing the cost of college.

A few other tips:

Working with 12th graders and their families, I get this question A LOT! What if I told you your child could go to a private selective 4-year college with a list price of $73,000 per year for the amount represented on your EFC? You say, “I make too much money.” What if your EFC came back as $28,000? Would you want to fill out the FAFSA then? The answer would be YES.

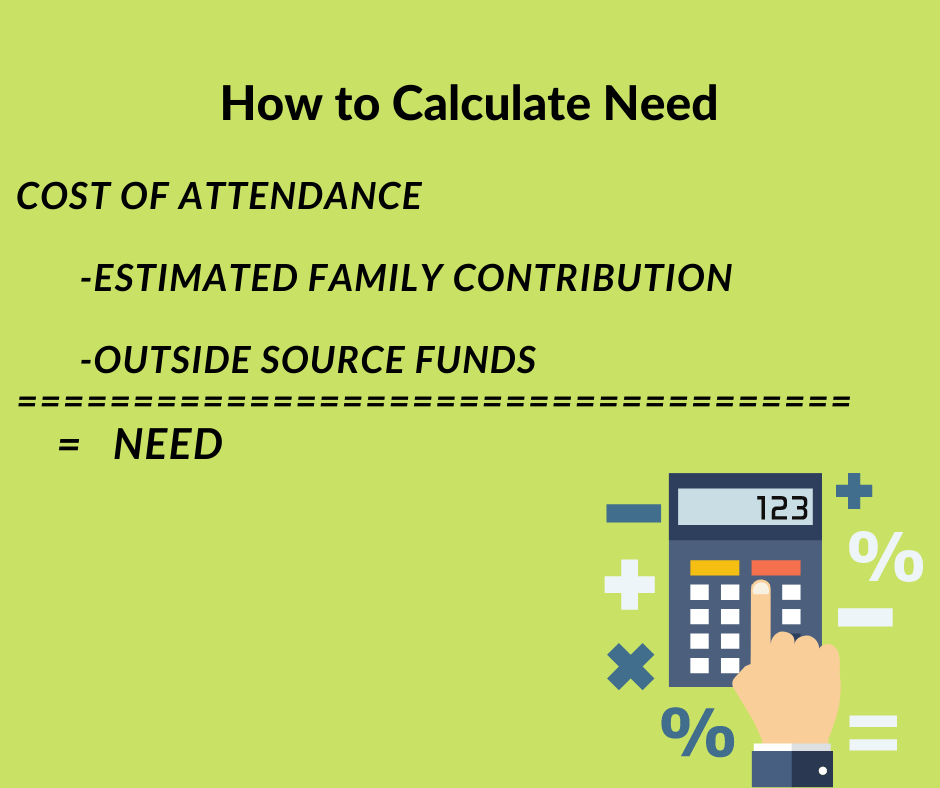

What is the FAFSA? The Free Application for Federal Student Aid. This application is what colleges and universities use to determine if a student has financial need. When you complete the FAFSA, you will receive a Student Aid Report (SAR), which shows your families Estimated Family Contribution (EFC). Based on your tax returns your EFC can range between 000000 – 999,999. The lower the number the higher the need. Families with an EFC lower than 6,000 are typically eligible for federal assistance like the Pell Grant. Colleges also use the EFC to determine use of state assistance and funding and that EFC can be higher to get access. Completing the applications not only gives access to federal aid in the form of grants but it gives all students access to federal student loans and parents access to Parent PLUS Loans.

What Determines Need:

Now I am not going to spend my time selling you on the FAFSA. There are plenty of websites and groups focused on encouraging students to complete this free application. These are the sites you want to visit to get the answer to all of your FAFSA questions.

One caution here, there are a ton of websites that want to provide you information on how to complete the FAFSA. While some might be helpful and reputable, some are trying to sell you something. How do I know? Five years ago, when I started this journey with my oldest going to college, I paid someone to help me complete the FAFSA. Back then you had to key in everything manually and they did not have the IRS Data Retrieval Tool. To be honest, I had heard so many horror stories about this process that I was afraid to try it myself. Guess what, I DID NOT NEED to pay for help. I could have saved my money. Your answers are your answers, and no one can play the system to change the outcome. If someone is telling you they can get you a lower EFC…RUN AWAY, they have some snake oil to sell. I am happy to report that using the IRS Data Retrieval tool made the next time I completed this form much easier.

If you are unable to use the IRS Data Retrieval Tool because of special circumstances, please do your research for your situation. Studentaid.gov has detailed information, instructions and videos to help. You can also reach out to your institutions financial aid department. CFNC.org is also partnering with NC schools to offer assistance. Click on the CFNC.org link in the above list to see help options.

If you are going to pay for college completely out of pocket and not utilize any student loans, work study, grants, scholarships and for some school’s merit aid, then NO don’t fill it out. Completing the FAFSA DOES give you access to:

Every school uses the FAFSA in some way. You really need to research the schools on your list to determine what they require and how they use it. Some schools will also require the CSS profile. There are 5 schools in NC that require this document and there is a cost associated to complete. That is a topic for a different blog. 🙂

So, to answer the first question, “Do I need to complete the FAFSA?” I would say, YES. And by the way, this is not a ONE and DONE thing. If you want access to the same funds, you will need to complete the FAFSA every year your student is planning to attend school.