During the admissions process, families are so focused on working to gain acceptance, that financial aid and cost is sometimes an afterthought. Not for long. The cost of college has increased exponentially over the past 2 decades and parents are often surprised at the total cost. This is often the final factor in deciding which school to attend. Here are a few things you should consider when comparing the cost of college.

- Know the TRUE COST

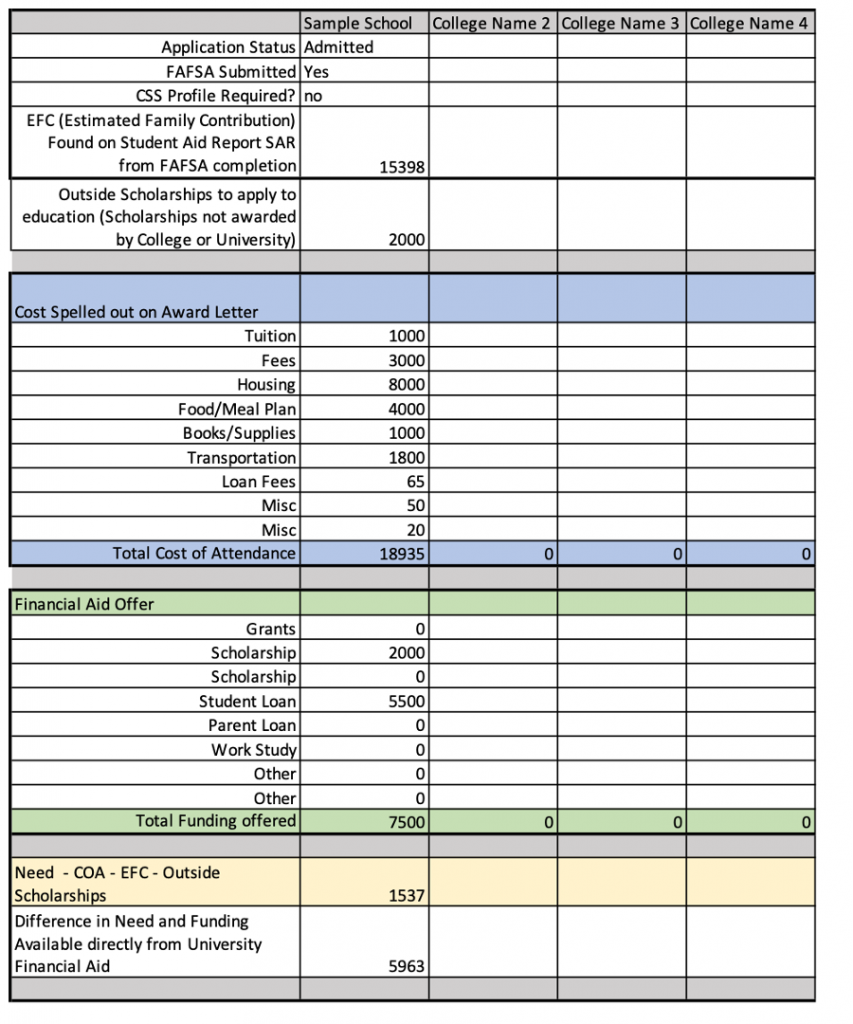

- Net price calculators on college or university websites are nice for estimates, but you really need to make sure you understand the TRUE cost of attendance. This is usually spelled out in the Financial Aid Award Letter. This document is either mailed or available for download on the college/university’s student portal. Some schools will release this information at time of acceptance, but others will wait until March or April. The amount they represent here is the amount used for calculating need. Often referred to as the Cost of Attendance or COA.

- The Award Letter is unique for each university and for each student. Typical costs are Tuition, Fees, Housing, Meal Plan, Books, Supplies, Transportation, Misc. – While these things go into the Total Cost of Attendance you will not necessarily write a check to the university for transportation or supplies, so they are just estimates and your major, distance from school to home, class selection can have an impact on these costs. So don’t look at another students COA.

- Make sure you compare Apples to Apples

- COA and specific line items can be referred to differently by each school. Example, one school might lump tuition and fees together, while another school might have 10-line items for different fees ranging from information technology, facility usage, recreation, loan payment fees, etc. Also, some schools will lump room and board together or they may breakup the items with housing and then a line item for meal plan or food. To complicate matters, your finial selection of dorm and meal plan, will have an impact on final cost of these items. Example – if you get your COA before you select your dorm and when you choose a dorm you select one that has an upcharge, suite style or apartment style dorms that have upgraded amenities might come at an additional cost.

- Create a Spreadsheet or Document that will help you compare each cost as a separate line item. You can do this with Excel, Google Docs or there are many free resources available to help with this.

- Look at your 4- year spend

- One of the first things you should consider is how many years will it take you to complete your degree. Like everything else, this is unique depending on your major, how many AP or dual enrollment classes you took in high school that are accepted by your college/university. If you were an early college student that completed your associates degree while you were in high school, you might still need to attend the college for more than 2 years. Do your research with each school and determine if they will take all your credits and if they apply directly to your major or if they are elective classes and you still need to complete all major classes which could add time to your schooling. Once you determine the estimated amount of time, multiply the yearly cost by the number of years to determine total cost.

- During this comparison, you want to consider cost of living on campus vs living off campus. Most off-campus housing will charge you for a full 12 months’ rent even if you are not there. You will want to include those extra months of rent and utilities in the cost of education. The cost of 4 years on campus at a smaller private school might be less than a 4-year public school in city with high cost of living.

- Reach out to Financial Aid Offices with questions

- Each school presents this information in its own format. If you have any questions or need clarification, please reach out to the school’s financial aid department. These professionals can offer clarity and help guide you in next steps.

- If you are struggling or feel that the calculation for need is incorrect, you will have to appeal with the Financial Aid department. Let me be clear, there might not be anything they can do, but if there are options and other opportunities for additional assistance, they would be able to let you know.

- DO NOT THINK YOU CAN WHEEL AND DEAL. I often have students who want to use acceptance into one college to get a better price at another. It does not work that way. No matter how many internet videos you have watched. Every decision or change made by a financial aid department is based on student specific information.

A few other tips:

- Understand the ROI (Return on Investment) – Go to Indeed.com or salary.com and look up your dream job and see what the average pay in the part of the country you want to live. If the salary is less than the yearly cost of your education, you might want to consider all your options. Example: If AVG yearly salary is $40k, you might think twice before paying 60k a year for 4 years for your education. How long will it take you to pay off those student loans? Is the cost of the school you have selected worth the investment. Can a less expensive school provide the same opportunities?

- Attend the Crosby Scholars Evaluating your Financial Aid Award Letter Academy – Open to students and parents. March 28, 2022, 7pm www.crosbyscholarsiredell.org

- StudentAid.gov is the federal student aid website. Lots of people try to make money from financing your education. Go straight to www.studentaid.gov with questions.

- Bookmark a glossary of terms that will clarify all the terminology associated with this process. Link to glossary of terms https://studentaid.gov/help-center/answers/topic/glossary/articles